There is no ideal percentage, but it’s recommended that your utilization not exceed 30%. For example, if you have 3 credit cards with balances totalling $7500, and the combined limits of the three cards is $15,000, your credit utilization is 50%.

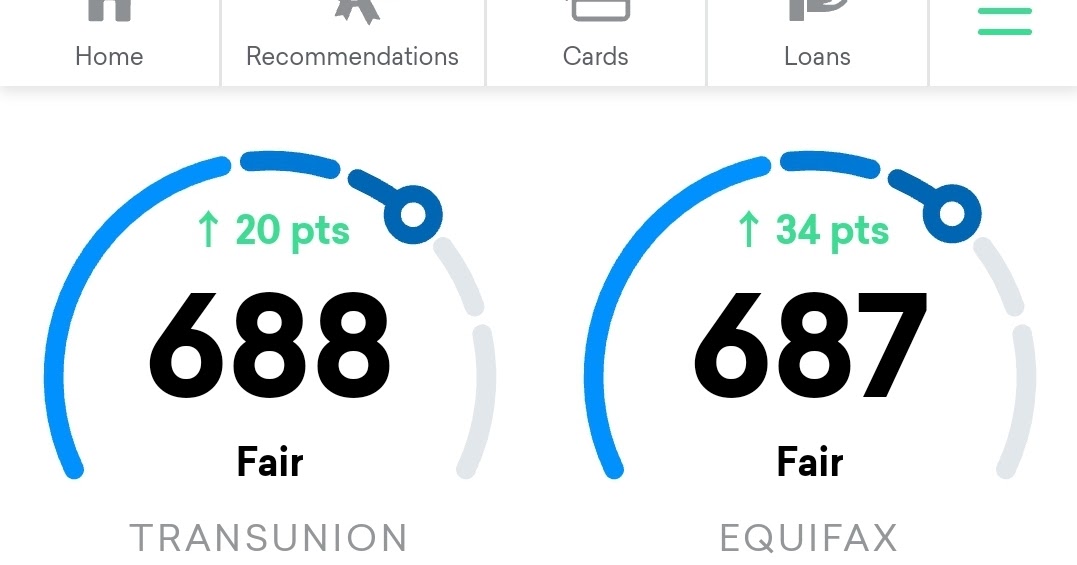

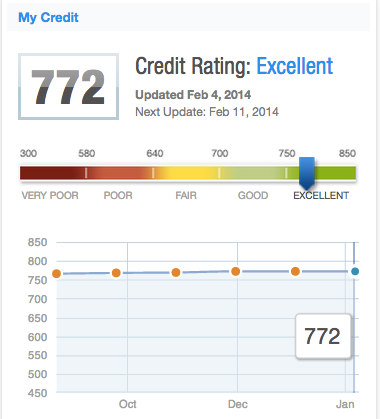

This is a ratio that measures the amount of revolving credit you owe divided by the amount you have available. Here’s a list of the most important ones, in no particular order: Credit Utilization There are several factors that go into determining your credit score. I’ve listed these below, to give you a general idea of how your score is categorized:īelow 600 Poor Factors Affecting My Credit Score What you need to know is that credit scores are grouped in ranges. It can be difficult to understand what is considered a good credit score, especially when the numbers vary between the two credit bureaus. Without a good credit score, certain aspects of life can be more difficult. Having access to credit makes it possible to purchase a home to live in, a car to drive, or have a credit card for day to day use. While too much debt is never a good thing, there comes a time when most people will need to borrow money. Both are legitimate credit scores, but the Borrowell and CK scores are the ones used by lenders, while the score you obtain directly from Equifax is more for educational purposes. This is because the score that the bureaus provide to Borrowell and Credit Karma are slightly different than the one they provide directly to individuals. The same goes for Credit Karma and Transunion. Why Are My Equifax and Borrowell Scores Different?Įven though Borrowell pulls your score from Equifax doesn’t mean that the two scores will be the same either. This means that the scores you receive from each company will differ, just like the scores from Equifax and Transunion. What’s important to note is that Borrowell uses the Equifax credit score, and Credit Karma uses Transunion. They make money through loans and credit card referrals that they offer to their members. Both companies will send you an updated credit score and report on a monthly basis, at no charge.

#CREDIT KARMA SCORE VS ACTUAL SCORE FOR FREE#

More and more Canadians are signing up for free monthly credit reporting from Borrowell and Credit Karma. You can choose to pay the bureaus for regular monthly online reporting, but there is a way to get monthly reporting, and an updated credit score, for free. Requests can be ordered by phone or by downloading a request form and mailing it in. As you can see, some use both Equifax and Transunion, while others only use one of the two.īoth Equifax and Transunion are required to offer Canadians a free credit report (no score) upon request, once per year. In case you’re wondering, I’ve included a list below of the major Canadian banks and the credit bureaus they use. Some credit grantors report to both, while others report to one and not the other.īecause the information being reported to each bureau varies, including when it is reported, the resulting credit scores won’t always be the same. Also, not every financial institution reports to both Equifax and Transunion.

There are a number of reasons for this.įor starters, Equifax and Transunion have their own proprietary algorithms, with each one assigning a different weighting to the criteria included in your score. When people obtain their credit score through Transunion and Equifax, they are often surprised to see a different credit score from each bureau.

In this article, I’ll explain why that is, and show you how you can get an updated credit score every month for free. But while the two companies serve a similar purpose, each one will give you a different credit score. In Canada, there are two credit bureaus that financial institutions use in the credit scoring process: Equifax and Transunion.

0 kommentar(er)

0 kommentar(er)